Basic Financial Statistics In The United States:

Credit Scores Range from 300 - 850

61+ million Americans with credit scores 599 or less

Half of Americans Do Not Know their credit score

Less than 3% know how their credit score is calculated

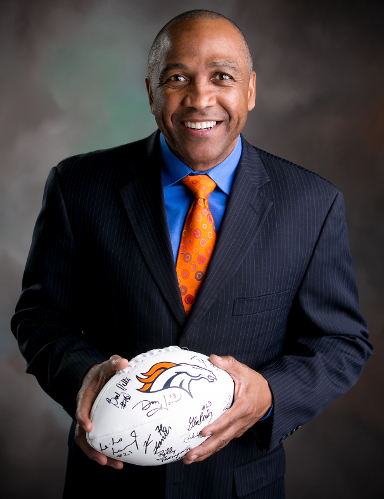

In 1986 I graduated from Purdue University. That same year I started my career in the National Football League (Denver Broncos). Over the last 33 years I’ve made millions of dollars but I’m sure you’ll agree with me… “It’s not how much money we make, it’s how much money we keep!” I’ve lost hundreds of thousands of dollars because I was unaware of the IMPORTANCE of my credit score (I was financially illiterate). No one taught me growing up and there’s a pretty good chance no one taught YOU.

Our Educational System DOES NOT prepare us! As adults, it’s up to US to Learn or… keep throwing hard earned money down the drain. I made the choice to Learn. I started this system with a 548 credit score. I had 14 negatively reporting items on my credit, including: 1 Bankruptcy, 3 charge-offs, 9 late payments and a repo!! I followed the system and NOW, my credit score is 727 and growing!! I only have 3 negatively reporting items, I pay less for all loans, better credit card rates and my insurance company lowered my insurance rate (UNSOLICITED).

I’m passionate about helping others NOT make the same mistakes I have. I want you to WIN in the credit game, eliminate debt and PROSPER!!